DIA RESPONDS TO NDIA PLAN MANAGER PRICE FREEZE

On 22 June 2022, the NDIA published its decision and outcomes of their 2021 – 2022 Annual Price Review. DIA acknowledges this pricing review provided pricing relief for many in the disability sector, however, no such relief was given to the providers of Plan Management who face a third consecutive year of a frozen price limits which equates to three consecutive real price cuts.

DIA welcomes and looks forward to working with the NDIA in a fully collaborative and co-design environment in undertaking a fulsome review of plan management to clearly define the roles, functions, and responsibilities of plan managers. DIA has done an enormous amount of work in this space, culminating in DIA’s Plan Management Professional Standards of Practice, which we hope will form the starting point for this upcoming review.

Although being aware of several policy issues that have required codesign, costing and decision-making by the NDIA for some time, the NDIA is now using this policy uncertainty as a reason for not being able to accept any cost model for plan management (including the cost model that DIA put forth in its price review submission). In not accepting any cost model, the NDIA is refusing to change the pricing that was set three years ago. These policy areas include:

- Decision making on behalf of a NDIS participant (which DIA opposes);

- Determination of whether a delivered support is considered reasonable and necessary;

- Plan Manager liability over participant’s claims (participant agent vs NDIA insurance adjuster);

- Debt recovery functions on behalf of the NDIA;

- Participant support brokerage functions;

- Fraud prevention functions; and

- Scale of audit and compliance responsibilities.

Whilst the base level of service delivery is reasonably defined within the market, all of the above items were considered ‘out of scope’ in DIA’s Annual Price Review submission as these policy areas remain undefined. As such we can understand that the NDIA might be uncomfortable in addressing pricing within the Plan Management market.

Given this, DIA would have preferred to see, and continue to recommend, the NDIA at least apply a CPI indexation to the Plan Management price limits. This would show the NDIA acting in good faith ahead of a fulsome review where the costs of these policy decisions can be properly implemented.

THE GOOD NEWS

There are some positives to come of the Annual Price Review.

As a member of the Plan Management Working Group, which met 2 of the 3 scheduled sessions, DIA is pleased to see that two of the issues raised by the Plan Management sector have been positively included in the 2021 – 22 Annual Price Review Final Report:

- Plan Visibility and the Responsibilities of Plan Managers; and

- Death of a participant.

Plan Visibility

Under the current privacy arrangements, a Plan Manager must request a copy of a participant’s plan, a request that can be denied, leaving the Plan Manager with little or no visibility of the plan they are managing.

Given the significance of both legislative and operational requirement to make this change, this is a positive recommendation from the Price Review, DIA looks forward to working with the NDIA in implementing a robust and adequate process that allows for participant privacy and the quality execution of plan management services to be implemented following an expedited review.

Death of a Participant

In the unfortunate circumstance where there is a death of a participant, plan managers are often required to lodge claims for services that have occurred prior the date the participant death, but where an invoice is sent to the plan manger after their death. Plan managers are currently not able to claim their monthly service fee for any services delivered after the death of a participant.

DIA supports and welcomes the recommendation that: The NDIA should allow Plan Managers to bill the agreed monthly plan management fee for up to three months after a participant’s death – so that they can finalise the participant’s outstanding invoices.

IMPLEMENTING THESE PRICING ARRANGEMENTS

There are operational questions stemming from this recommendation which DIA will engage with the NDIA on as this recommendation is operationalised.

Theses are listed below, DIA will provide updates on these matters as soon as possible.

Establishment Fees for Plan Extentions

The 2022-2023 NDIS Pricing Arrangements and Limits now states that:

A plan manager can only claim for the support item 14_033_0127_8_3 (Plan Management – Set Up Costs) once in respect of each plan. Auto-extended plans are not new plans – they have the same plan number. Plan managers are not entitled to make another claim for this support item from a plan when it is auto-extended.

The NDIA has previously given DIA, its members and the public a clear understanding that when a plan is auto-extended an Establishment Fee could be claimed as the work required from a plan manger was the equivalent of an initial setup. DIA and the sector have been blindsided by this change. This issue was not raised in the Consultation Paper or in either of the two Working Group meetings.

For clarity below is an analysis of the task a Plan Manager needs to undertake to establish a new plan, which is paid for by an Establishment fee, versus that of a plan extension.

| Task | New Plan Implementation by a Plan Manager |

Plan Extension Implementation by a Plan Manager |

| Inform the Participant about respective responsibilities to ensure supports obtained are aligned with a participant’s NDIS plan | ✓ | ✓ As the plan values and duration of the original plan have been changed a Plan Manager needs to discuss this with the Participant |

| Confirm with the Participant there is sufficient NDIS funding in a participant’s plan for supports | ✓ | ✓ As the plan values and duration of the original plan have been changed a Plan Manager needs to discuss this with the Participant |

| Establish preferred method of invoicing and/or how receipts for reimbursement are exchanged | ✓ | – In the main this will remain unchanged. |

| Establish preferences with the Participant regarding visibility over provider invoices sent to a plan manager | ✓ | ✓ As the plan values and duration of the original plan have been changed a Plan Manager needs to discuss this with the Participant |

| Establish with the Participant a well defined and understood dispute resolution processes. | ✓ | – In the main this will remain unchanged. |

| Manually establish the quarantining of plan managed funds through NDIS portal (Establish special Plan Managed Service Bookings) | ✓ without this the NDIS participant can’t claim for any supports. |

✓ without this the NDIS participant can’t claim for any supports. |

The realities of what is involved in implementing a plan extension for NDIS participants is in the main the same as a new plan. To say that this work does not need to be undertaken just because the Plan number remains the same in disingenuous and leaves plan managers and DIA to ask – if the NDIA is no longer going to fund this work who will be doing it as it is clearly not a function covered for in the monthly transaction fee.

DIA is working hard to explain to the NDIA that this work needs to be funded. What is ridiculous, is that when a NDIS plan is extended it includes this establishment fee. What this price guide is saying is despite these funds being in the plan and despite the work you need to do implement the plan you cannot claim it.

Given the lack of consultation, the time involved in processing plan extensions and the freezing of the price limits (monthly and establishment), DIA will be seeking further clarity on this decision from the NDIA in a dedicated and escalated body of work.

Plan Management Members are encouraged to write to the NDIA expressing their dissatisfaction with this measure. DIA has created a template letter for sending to the NDIA which can be download below.

DOWNLOAD: PLAN MANGEMENT TEMPLATE LETTER TO THE NDIA

Plan Indexation

DIA applaud and welcome the decision to index plans in line with the price increases announced, however are plan managers expected to update these values in each and every special Plan Managed service bookings within the current monthly price setting as per previous changes implemented by the NDIA?

DIA questions why plan managers are expected to absorb these costs which stem from NDIA’s poor business system and its limitations. The NDIA expects the market to operate at peak efficiency however provides little support to the Plan Management market when it comes to work created by NDIA’s own inefficiencies and limitations.

In the past the NDIA, has update plans and plan manged service bookings automatically, however this has been removed in recent years due to system limitations, forcing plan managers to undertake thousands of hours of manual process just to facilitate claims and funds to flow.

Requirement for Qualified Therapists

With the inclusion of prescribed qualifications and affiliations in the price guide along with the statement that specified line items can only be used by providers with the stated qualifications, will there be an expectation on plan managers to be verifying certifications and/or APHRA registrations for all providers at time of claiming?

Will the NDIA being doing this for Agency Managed participants? i.e. pre-claim rather than post-claim audits?

Other Therapy

As many of you are aware the “other therapy’ lines items were removed. These have since been corrected and re-instated.

Death of a Participant

It is recommended that plan managers will be able to claim the monthly fee for “up to 3 months” after the date of a participant’s passing. DIA seeks clarity of any conditions or expected service delivery that the NDIA expects to be undertaken in order for plan managers to claim during this period.

Will the NDIA be leaving the standard service booking active for the 3 month period or will the service booking be end dated by the NDIA on the date of passing (as it is now) with funds left available for claiming against?

THE BAD NEWS

Yes you read that right, the NDIA has frozen the price limits for Plan Management for a thrid year in a row, a price cut in real terms.

The Final Report leans heavily on the concept that the Plan Managed market is “in a state of flux, highly variable and not yet mature”. To substantiate this claim, the NDIA states:

- Significant new numbers of plan managers enter the market each quarter;

- The average transaction cost per plan management transaction in 2020-2021 was $53.98.

- The average funds management ratio (ratio of fee to cost of supports purchased) was, on average, 28.5% in 2020-2021.

- Management ratio compared to Visa / Mastercard transactions, Superannuation accounts and global healthcare markets.

- MEAN Profitability as measured by the percentage of providers and average profit level as identified in the DIA submission.

DIA finds these points to unfairly represent the underlying trends in the plan management sector for the following reasons:

Sector in a 'State of Flux'

Although there has been an increase in the number of registered plan management providers, the latest NDIA quarterly report (Q3 2021 – 22) suggests that the increase over the past seven quarters has been 3.0% per quarter versus an average 8.6% increase in participants requesting plan management per quarter.

The NDIA even states that “while new plan managers are entering the market and increasing the number of plan managers from which participants can choose from, many plan managers are also expanding as the ratio of participants to providers has increased.” (p.81 NDIS Quarterly Report to Ministers Q3 202122). Not the picture DIA would expect of a market in a state of flux.

Furthermore, in Section 8.1 Current Arrangements – Changing Plan Managers, the report finds that the number of participants using one plan manger during 2021-2022 was a whopping 91.6%! Again, DIA would expect a much higher number of participants to be “shopping around” in a market that isn’t mature, highly variable and in a state of flux. This is clearly not the case.

Average Transaction Cost

The high “average” cost of each plan transaction is reported as a reason to keep the current pricing arrangements in place as there “appears to be considerable scope for further efficiencies in the sector”. DIA agrees that, with more policy certainty, as above, that the sector will continue to drive efficiencies however, to imply that there is a high “average” transaction cost is misleading.

In section 8.1. Current Arrangements – Providers the report finds that the average is indeed $53.98 but half of all transactions were completed at a cost below $20.08 and a quarter below $9.98, this clearly shows a dramatic skew. The NDIA should have used a more representative figure, such as the median instead.

DIA has long called out the NDIA for using averages on long tail data and explained the impact this has when compared to using the median in our submission. When viewed with this in mind, the level of latent efficiency in transaction costs is much less than the NDIA is suggesting.

Further the NDIA CEO, Mr Martin Hoffman is on record as saying, “The Plan Manager role surely has to be more than just a blind post office box passing on whatever is invoiced by providers and expecting payment in full from the Agency.”

It is therefore surprising that the transaction costs discussed above are directly compared to those of Visa/Mastercard. For the NDIA to now imply that a key Plan Management metric to determine the health of the market is simply the cost of transactions is baffling and belittles the incredible work that Plan Managers do – beyond just make claims and dispersing those funds to providers.

The NDIA Q3 2021-22 Quarterly Reports shows the March 2022 Quater:

| Total NDIS Funds Claimed by Plan Managers | $3B |

| Total amount claimed by Plan Managers for their services (Choice and Control Support Category) |

$107M |

Source NDIA Website: QR Q3 202122 Full report.pdf

A simple calculation of:

- (Total amount claimed by Plan Managers for their services) / (Total NDIS Funds Claimed by Plan Managers) = Average Claiming Ratio:

- $107M / $3B = 3.56%

Or to put it in even simplier terms for ever $1 a Plan Manager claims on behalf a participant the Plan Manager is paid just 3.56c.

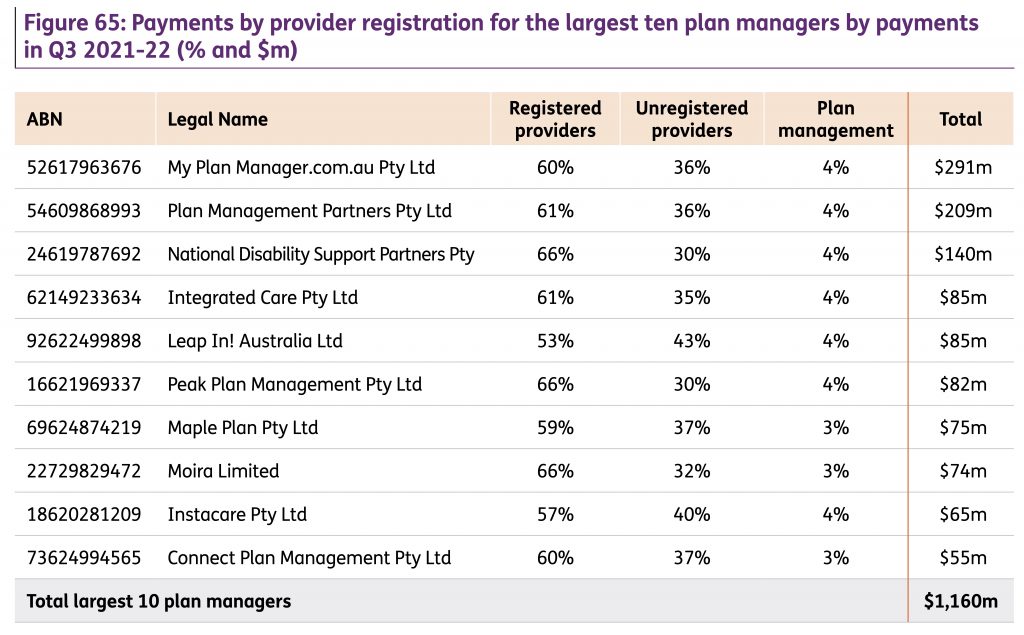

Further, this position is supported by the NDIA’s own analysis of the largest 10 plan managers, which shows that as a percentage of claims that Plan Managers are operating at a cost to the NDIS of between 3% and 4% of claimed funds for their services. Noting that this is against funds being claimed with is less than funds being managed due to average utilisation of NDIS participants of their plan. But again, demonstrates that the NDIA’s representations on this issue unfairly represent the underlying trends in the Plan Management sector.

Average Management Ratio

In a similar vein, leading with the average management ratio figure of 28.5% is an attempt to set the narrative in the context of plan management supports being highly profitable for providers and poor value for money for participants. The report itself acknowledges that this figure is highly variable and skewed by a small number of high per cost participants and states the mean management ratio is 8.7%. Even this seems high in DIA’s view, particularly given The NDIA Quarterly Reports shows that during 20-21 financial year:

| Total NDIS Committed Plan Funds | $32.329B |

| Per cent of Total NDIS Committed Funds – Plan Managed | 36% |

| Total NDIS Committed Plan Funds – Plan Managed (Total NDIS funds under management by Plan Managers) |

$12.932B |

| Total amount claimed by Plan Managers for their services (Choice and Control Support Category) |

$305M |

| Total Number of Plan Managed Participants | 239,857 |

Source NDIA Website: QR Q4 202021 Full report.pdf and QR Q3 202122 Full report.pdf

A simple calculation of:

- (Total amount claimed by Plan Managers for their services) / (Total NDIS Committed Plan Funds – Plan Managed) = Average Management Ratio

- $305M / $12.932B = 2.62%

So, when the entire Plan Management Market’s Average Management Ratio is at 2.62%, for the NDIA to claim that average funds management ratio is 28.5% or even 8.7% is simply misrepresenting the operational realities of the NDIS Plan Management Market.

Profitability

The Report quotes the DIA submission that 54% of the plan management respondents (430 in total) had reported a profit and that the average EBITDA was 24%, this is a correct representation of the DIA data. What was left out of the report, not overly surprisingly, was that the Median EBITDA was a significantly lower number of 3% which is a far better representation of the actual market operating conditions.

DIA’s submission was detailed and transparent. DIA did not cherry pick data that supported a position, we presented a true and accurate representation of the market on the ground. Given the disparity with these two-profitability numbers it is misleading for the NDIA to only reference the average given the skew that is clearly present.

In DIA’s view, one-sided commentary such as this will only serve to drive lower skilled and less qualified providers into the market chasing easy profitability that clearly does not exist, leading to poorer outcomes for participants.

Value for Money

It is surprising that the transaction costs discussed above are directly compared to those of Visa/Mastercard, Superannuation funds and global healthcare transactions, hardly worth comparing (disclaimers notwithstanding) in DIA’s opinion.

In DIA’s view the answer is simple. Plan Management is more than just a simple transactional service which represents great value at 2.6% Average Management Ratio and 3% to 4% Ratio to Funds Claimed. Comparable markets for services and support based on DIA’s research indicates that in 2020-21:

- Financial Services sector operated at around 14.6%;

- Administration and Support Services sector at around 8.7%;

- Health Care and Social Assistance sector (private) at around 18.0%;

- Administration and Insurance sector (public) at around 8.1%; and

- Professional Services sector operated at around 20.4%.

Source: Australian Bureau of Statistics 2020-21

Market Maturity

In the opening paragraph of section 8.4 Discussion, the report states “It is clear that roles of, and expectations on, plan managers are still evolving. Neither the service offering nor the market has full matured and the context within which plan managers deliver their services is also not fully developed”.

Save for the policy gaps noted at the top of this page, DIA find ourselves asking – which is it?

- Is the Plan Management market immature and with undefined role scope and function, if so this mean that it would require a transition funding model design to develop and increase quality, innovation, and improved participant outcomes; or

- Is the Plan Management market maturing enough that participants are reasonably stable in their service arrangements with their Plan Manager with a value for money proposition worth the comparison with Visa / Mastercard and Superannuation etc; in which long tail efficiency price modelling is appropriate.

The NDIA can’t have it both ways.

In the NDIA’s own opinion (Guide to Plan Management September 2020) it clearly states:

Plan management refers to the financial administration of a participant’s NDIS plan on a participant’s behalf. This service will assist a participant by:

- Managing and monitoring a participant’s budget in accordance with the plan management service agreement for the duration of the NDIS plan

- Managing the NDIS claims and disbursing funds to providers for delivered services

- Maintaining records for a participant and producing regular (at least monthly) statements for participants showing the financial status of a participant’s plan, and

- Providing access as required to a wider range of service providers, including non-registered providers, while ensuring compliance with the price limits contained within the NDIS Price Guide.

The Guide further states that a Plan Manager will provide:

- Information [to the participant] about respective responsibilities to ensure supports obtained are aligned with a participant’s NDIS plan;

- Confirmation [for the participant] there is sufficient NDIS funding in a participant’s plan for supports;

- A preferred method of invoicing and/or how receipts for reimbursement are exchanged;

- [the Participant with the] preferences regarding visibility over provider invoices sent to a plan manager;

- [the Participant with the] plan manager’s process for receiving and managing invoices;

- [the Participant with the] responsibilities of a participant and plan management provider for ongoing monitoring and management of plan budget;

- [the Participant with the] well defined and understood dispute resolution processes;

- Manually establish the quarantining of plan managed funds through NDIS portal (Establish special Plan Managed Service Bookings).

DIA contend that any comparison to purely transactional services is highly inappropriate and does a disservice to the providers of plan management and the participants that access this service. DIA provided an extensive analysis of why participants choose to have their NDIS funds plan managed in our 2022 State of the Australian Disability Intermediaries Sector Report; this analysis clearly states that the reasons go well beyond simple transactional processing.

Further, save for the policy gaps noted earlier, which DIA have been trying to address with the NDIA in some case for years, the base service delivery as specified under the NDIS Act and operationalised through the guidance of the Guide to Plan Management September 2020 reasonably articulates the base service, role and function that a Plan Manager plays.

Whilst difficult to express, DIA must remind providers who plan to exit and cease delivering services to NDIS Participant that they have obligations under the NDIS Commission regardless if you are registered or not. If you are in this position, please contact DIA directly at info@intermediaries.org.au for support.

DIA is a members-based organisation. We are only able to do the work that we do because of the ongoing support of our members. Thank you to all DIA members that continue to support the work we do. If your a provider delivering Support Coordination or Plan Management are not yet a member, you should consider joining.